Roll over Kredit translation in German - English Reverso dictionary see also RolleRolliRollorollen examples definition conjugation. Any line of credit that can be borrowed against up to a stated credit limit and into which repayments go for crediting.

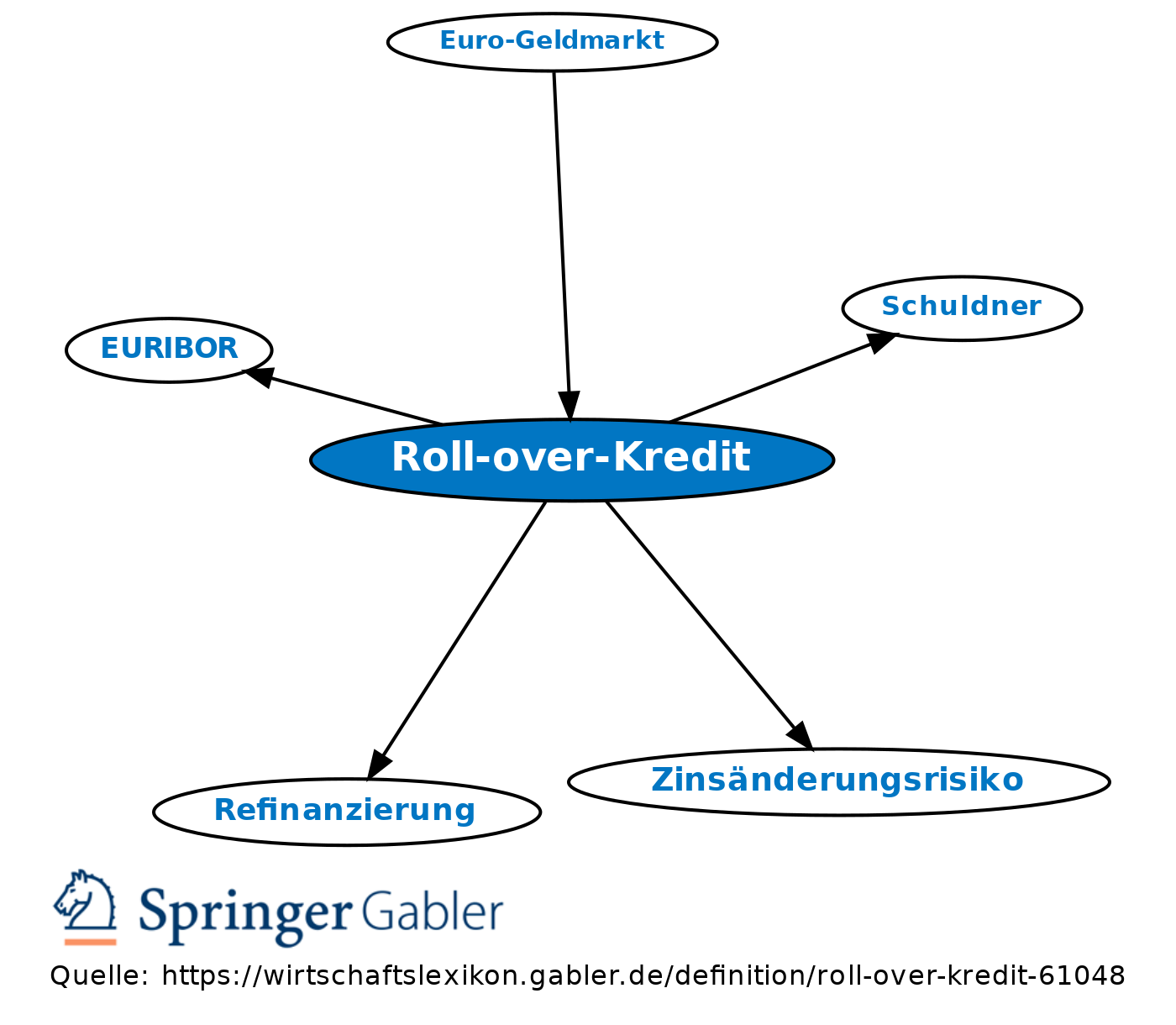

Roll Over Kredit Definition Gabler Banklexikon

Definition of Rollover credit.

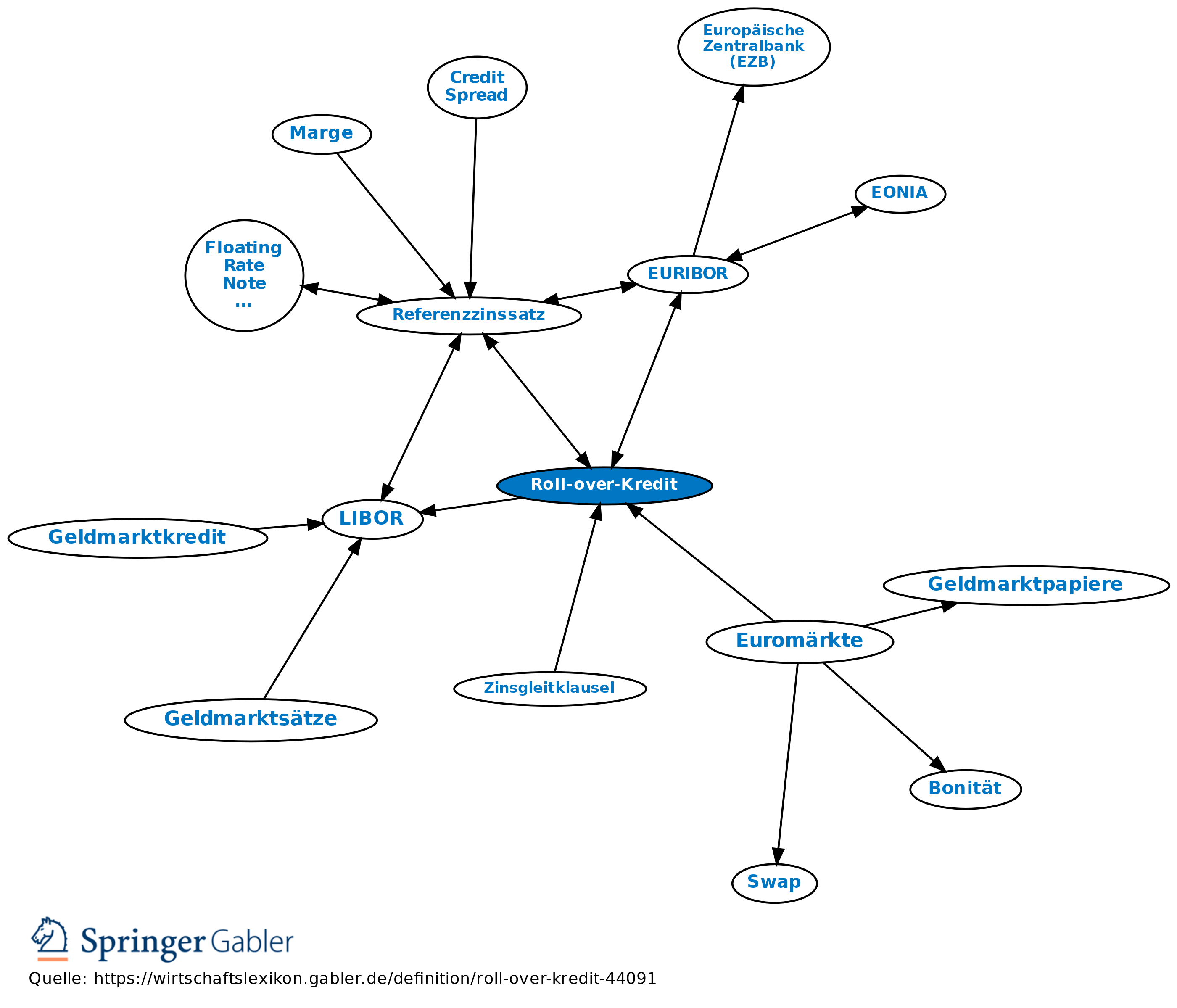

Roll over kredit definition. Rolling-over a Drawdown Loan. The terms and conditions of the new loan may be different to those of the original loan. Der Roll-over-Kredit ist ein mittel- bis langfristiger Kredit mit spezieller Zinsvereinbarung.

Roll over a loan. Instead of entering into default as would be the case with other types of loans the debt is simply carried over to a new loan. To agree to what someone wants especially because you are under pressure or under someones.

A rollover loan is a type of loan which is automatically renewed when it is not repaid in full within a predefined loan term. When debt market liquidity deteriorates firms face rollover losses from issuing new bonds to replace maturing bonds. Mengenai apa yang dimaksud dengan roll over facility agreement Menurut Kamus yang dimuat dalam situs resmi Bank Indonesia bigoid disebutkan bahwa rollover adalah.

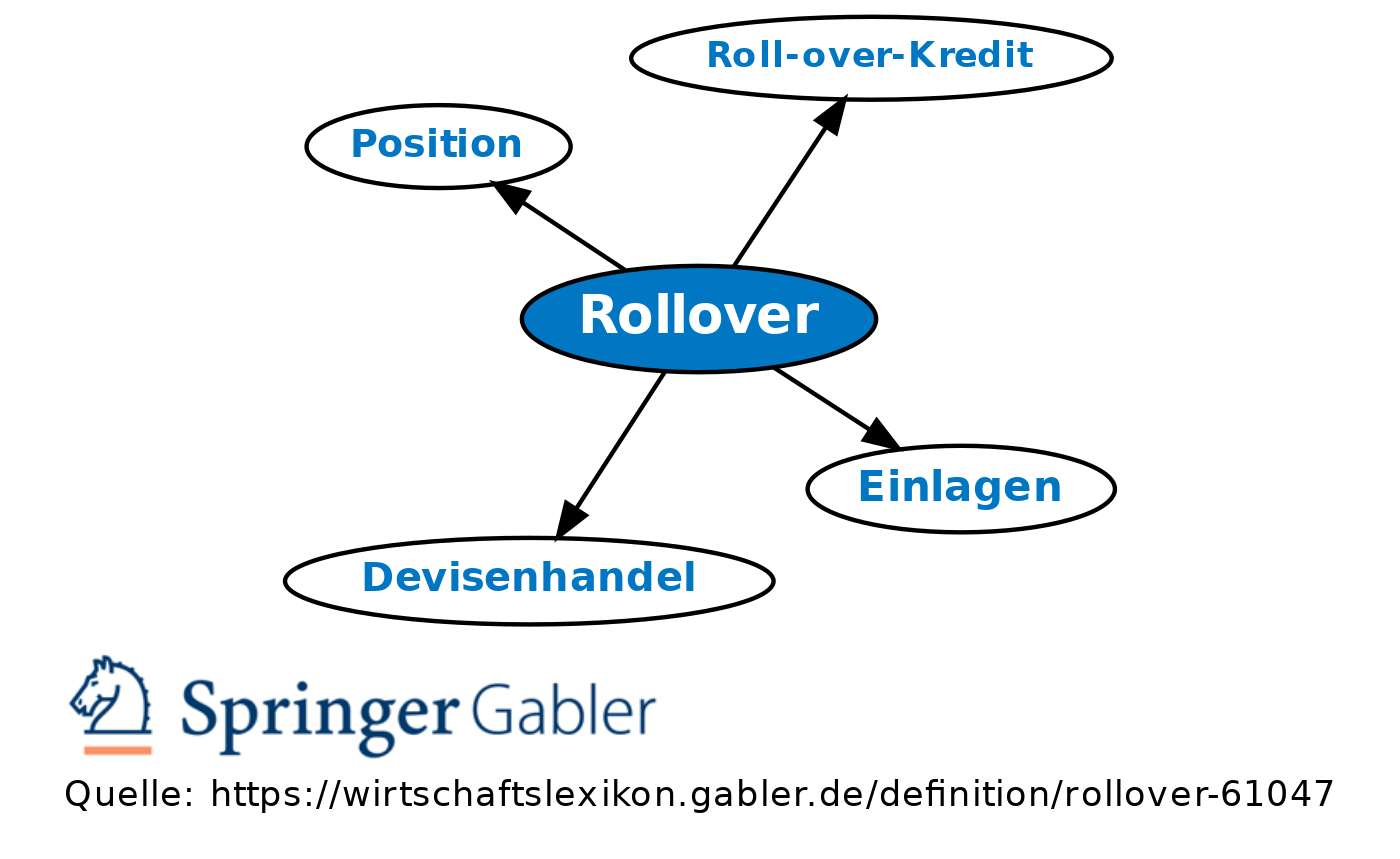

Roll over verb re-invest a previous investment into a similar fund or security. Roll over verb negociate to repay a loan at a later date for an additional fee. What does roll-over mean.

Rollover risk is a risk associated with the refinancing of debt. Instead of liquidating a loan on maturity you can roll it over into a new loan. As a minimum youll always be able to roll over up to 10 unused credits - even.

If you are set to switch to a 27 credit plan up to 27 unused credits will roll over. Business There seems to be no way to spread out the tax or roll over the cash. For example if youre set to renew on a 45 credit plan you can roll over up to 45 unused credits into your next cycle.

What Is a Rollover Credit. Memperpanjang jatuh tempo atau memperbaharui suatu pinjaman atau kewajiban. If you roll over a loan or other financial arrangement you extend it for example by adding it to another loan.

To avoid default equity holders need to bear the rollover losses while maturing debt holders are paid in full. A rollover credit is a net payment of interest received by a forex trader who holds a long position on a currency pair overnight when the long currency pays a higher rate. See letter of credit.

Der Zinssatz wird nicht für die gesamte Laufzeit festgelegt sondern periodisch an den Markt- Referenz-zinssatz zB. Die Kreditlaufzeit wird in Zinsperioden Roll-over-Perioden untergliedert. The outstanding principal and other components of the old loan are rolled-over with or without the interest outstanding on it.

To move funds or an investment from one position or investment to another. What Is Rollover Risk. A rollover is the renewal of a loan.

She rolled over her IRA. To agree to what someone wants especially because you are under pressure or under someones. Rollover Commercial Paper means any Commercial Paper which is issued in the amount of and for the repayment of existing Commercial Paper on the maturity thereof or Affiliate Subordinated Debt issued to repay Commercial Paper issued for the Borrowers general corporate purposes or to provide working capital for the Borrower as applicable and for which CP Commitments are then outstanding under the.

Rollover risk is commonly faced by countries and companies when. Between debt market liquidity and credit risk through so-called rollover risk.

Rollover Definition Gabler Banklexikon

Der Rollover Kredit Hintergrunde Und Details

Rollover Definition Gabler Banklexikon

Roll Over Kredit Definition Gabler Wirtschaftslexikon

0 Kommentare